inheritance tax waiver form florida

Youll need to provide a death certificate will and a petition form. There are limits on what an executor can and cannot do.

For full details refer to NJAC.

. Any Rhode Island state tax. Waiver of Interest penalties surcharges and any other additions to tax. Hello and thank you for your comment.

Florida inheritance tax planning has income tax consequences to the extent that the gross estate includes assets that have appreciated in value. The federal government however imposes an estate tax that applies to all United States Citizens. An inheritance tax is imposed on someone who actually receives an inheritance.

Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022. This can also include related conditions such as debt alimony spousal support or budget plans for retirement. Individual Income Tax Transmittal for an IRS e-File Return to submit any paper documents that need to be sent after your return has been accepted electronically.

Generally the document is used if a person dies without a will and the probate court is trying to determine how the estate should be distributed. If they turn around and sell the house for its 200000 value but you only paid 50000 for the property way back when. You dont need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return.

Step 1 Gather any documents that prove the benefactor passed and left. Connecticut and New York have some form of a gift tax and estate tax as well. All forms of tax-deferred retirement plans are protected.

1826-111 - 1125 Waivers Consent to Transfer How to Obtain a Waiver. Waivers Form 0-1 can only be issued by the Inheritance Tax Branch of the NJ. If you sign a waiver and consent document you may later be barred from exercising your rights in the estate proceeding in the future.

The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. Florida Inheritance Tax Planning. An executors authority isnt endless.

By executing a waiver and consent document the distributee waives his or her right to a citation being issued by the court and consents to the courts appointment of the administrator or executor. The credit is equal to a maximum of 1100 for owners and 750 for renters. If you received an inheritance during the tax year in question the IRS might require you to prove the origin of the funds.

During this phase the court appoints the executor or a representative. 529 of the Internal Revenue Code of 1986 as amended including but not limited to the Florida Prepaid College Trust Fund advance payment contracts under s. 100998 and the Florida Prepaid College Trust Fund participation agreements under s.

This doesnt mean youre stuck though. Heres what you should know. The federal estate tax only applies if the value of the entire estate exceeds 12060000 million 2022 and the tax thats incurred is paid out of the estatetrust rather than by the beneficiaries.

What If the Recipient Sells the Property. Puerto Rico Amnesty Page. Additional fees apply for Earned.

What is a Postnuptial Agreement. For general information about e-file refer to E-File Options for. Seniors in Missouri may be eligible for a form of property tax relief called the Missouri property tax credit.

The statutory exemption specifically includes pension plans designated for teachers county officers and employees state officers and employees police. In addition to helping those in need you could potentially offset the taxable gains on your inheritance with the tax deduction you receive for donating to a charitable organization. As with estate tax an inheritance tax if due is applied only to the sum that exceeds the exemption.

Any taxable period ending on or before December 31 2016. During this time you cant do anything with the property other than maintaining it. Tax is usually assessed on a sliding.

To qualify homeowners must be at least 65 years old and they must own and occupy their home. December 1 2017 - February 15 2018. Free Postnuptial Agreement Form.

Two additional Withdrawal options resulted from the Commissioners 2011 Fresh Start initiative. For eligibility refer to Form 12277 Application for the Withdrawal of Filed Form 668Y Notice of Federal Tax Lien Internal Revenue Code Section 6323j PDF and the video Lien Notice Withdrawal. The executor or administrator of the estate is responsible for filing the inheritance tax return form and making sure that the inheritance tax is.

Pensions 401k plans IRAs and other tax-deferred retirement assets are protected from creditors in Florida under Section 22221 of Florida Statutes. Income tax inheritance and gift tax and special real property tax. C All qualified tuition programs authorized by s.

Your child inherits your tax basisbasically what you paid for the propertywhen you transfer it to them as a gift during your lifetime. We recommend you speak with. Please consult with your financial advisoraccountantattorney No tax is claimed upon the following items of property described as being in your possession or under your control in your report of _____ relating to the estate of_____ late of _____.

Because you are in Illinois it is possible you could be taxed. That being said the executors fiduciary duty to the estate and therefore the estates beneficiaries prevent him or her from just sitting on the will without good. Postnuptial agreements are very.

The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes. Use Form 8453 US. Assets left to a surviving spouse after applying the deceased spouses unified credit acquire a stepped-up basis to the date of the first spouses death.

If youre expecting to leave money to people when you die consider giving annual gifts to your beneficiaries while youre still living. Inheritance Tax Waiver This Form is for Informational Purposes Only. Stay with us and well give you a solution to how you can start the sale process.

Submitted by Marcin Gulik on Mon 07132020 - 1336. Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. Other states such as Texas have a window of four years after death to begin the probate process.

Some states like Oregon and Florida for instance have no stated time limit for an executor to submit the will. If the deceased was from Florida and the beneficiary pod lives in Illinois is this a taxable thing. Type of federal return filed is based on your personal tax situation and IRS rules.

An Affidavit of Heirship is a written solemn oath that verifies the named individual is a legal heir of someone who died. As mentioned Florida does not have a separate inheritance death tax. Full-year owners must have total income of 30000 or less if they are single filers.

We would like to show you a description here but the site wont allow us. Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips some scholarshipsgrants and unemployment compensation. Exact Forms Protocols Vary from State to State and.

You can give a certain amount to each person15000 for. A postnuptial agreement or postnup is a contract that states how assets between spouses will be divided and handled should the marriage or civil union end.

L9 Form Fill Online Printable Fillable Blank Pdffiller

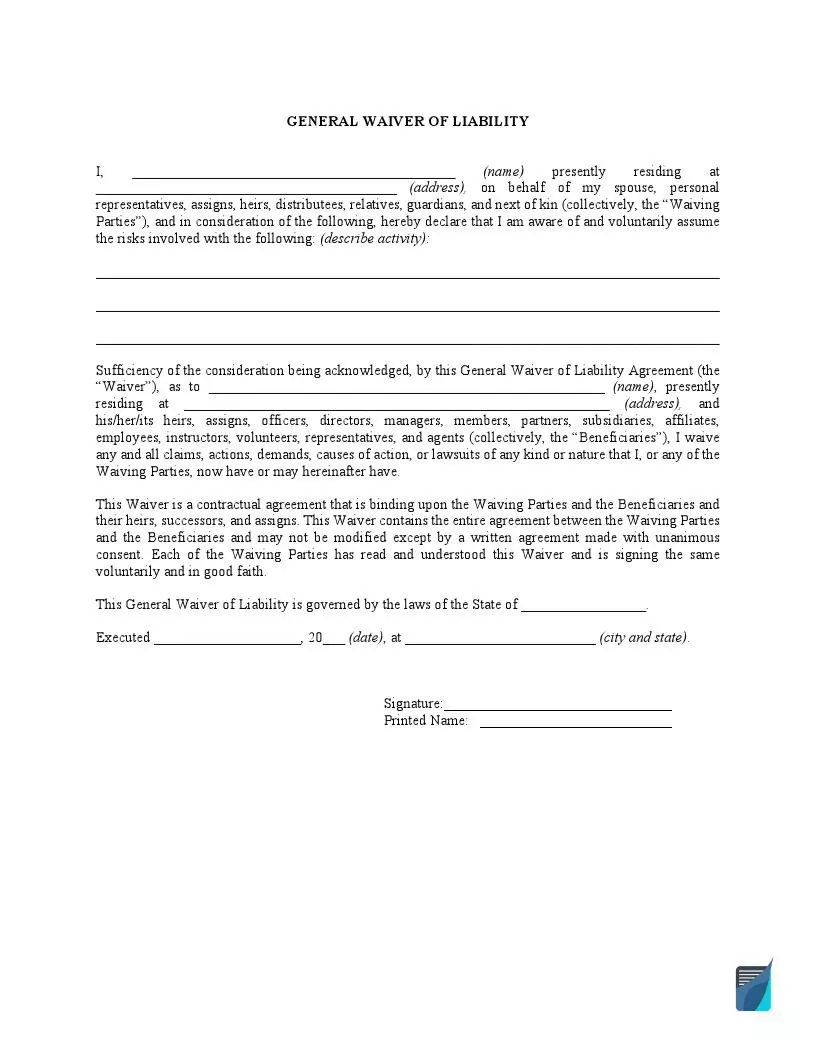

Free Printable Release And Waiver Of Liability Agreement Form Generic Liability Waiver General Liability Legal Forms

Tax Waiver Fill Out And Sign Printable Pdf Template Signnow

Florida Commercial Lease Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Formats Like Word Exc Lease Templates Legal Forms

Quit Claim Deed Pdf Quites Quitclaim Deed Words

Florida State Employee Tuition Waiver Program Participation Form Download Fillable Pdf Templateroller

Release Of Lien Form Florida Fill Online Printable Fillable Blank Pdffiller

Form Dacs 16009 Download Printable Pdf Or Fill Online Personal Inquiry Waiver Authority For Release Of Information Florida Templateroller

Lien Waiver Form Fill Online Printable Fillable Blank Pdffiller